Our financial health

Audit income

Actual revenue for the year ended 31 March 2022 was R4 395 million, representing a year on year increase of 29% from R3 395 million in 2020-21. Of this percentage, about 23% relates to revenue from the catch-up audit work that could not be completed in the previous year. The results were achieved by proactive continuous plans that included:

- a drive to achieve efficiencies through staff pooling between national and provincial business units

- a determination by our audit teams to achieve better productivity and recoverable rates (own hours’ revenue).

We generated an audit income of R979 million or 22% (2020-12: 18%) through the audit work outsourced to private firms. This increase was also driven by catch-up audits that could not be completed in the previous financial year.

Our overhead expenses of R1 447 million was R48 million above the previous year’s expenditure of R1 399 million. We managed the increase in overheads as we continued our costs optimisation practices, and our culture of consciousness continued to have a positive impact.

Debtors

The cash collections for the organisation performed exceptionally well for the year, R5 billion was collected, which is R2 billion or 55% more than in the previous year.

The slight decrease in the overall debt owed to us indicates the success of our concerted collection strategies. We continue to leverage our strategic relationship with stakeholders such as the National Treasury and provincial treasuries to address our concerns regarding this debt.

At 31 March 2022, we were owed R1 060 million, which was a decrease from the R1 085 million owed in the same period last year. Local and district municipalities owed us 52 %, or R548 million, while SOEs and public entities owed 23%, or R243 million. Of the debt, R311 million or 29% (2020-21: R291 million) was owed for 120 days or more, mainly by auditees in financial distress.

The decrease in local government debt, from R722 million in March 2021 to R548 million in March 2022 is due to the delay in the local government audits last year. This year, the majority were completed on time. In addition, our concerted collection efforts through a debtors sprint project and collaboration with the National Treasury played a part in increasing our debt collections.

Local government debt is still concentrated in the Northern Cape, Eastern Cape, Free State and North West.

Debt collection

We continue to enforce collections in line with our accounts receivable policy and the Public Audit Act. We also made notable strides in collecting debt using the following strategies:

- Engagement with National Treasury, which continues to yield positive results. We reported the risk to our liquidity of some auditees not settling their audit fees. With the intervention of the National Treasury director-general, we collected R94 million.

- We negotiated a R70 million debt settlement to liquidate old debt for financially distressed and 1% debtors. This was in addition to the R71 million allocated for this purpose and which we also received during the year.

- We continue to provide auditees with opportunities to reduce their debt through ring-fencing payment arrangements. We collected a cumulative

R471 million since the beginning of this initiative, with R53 million collected in 2021-22 (2020-21: R31 million). We consider this initiative very effective, especially for those financially distressed auditees that would have not ordinarily have settled some of their debt.

Where auditees do not settle their audit fees or form payment arrangements, we will litigate to recover the debt, in line with the Public Audit Act. This approach contributed to recovering long outstanding debt, as we collected a cumulative R642 million, with R156 million collected in 2021-22.

Our litigation cost is contained to only R0,2 million (2020-21: R0,1 million) as most of this work is done by our in-house legal team.

Provision for impairment of debtors / doubtful debt

We halted the overall increase in the debt book; however, the quality of the debt owed by SOEs and local government, especially in the Eastern Cape, Free State, North West and Northern Cape, remains a concern. As a result, the provision for impairment of debtors increased from R198 million in 2020-21 to R213 million. The provision for impairment is 20% (2020-21: 18%) of the outstanding debt, which means that for every one rand owed to the AGSA, 20 cents may not be collectable.

Cash flow

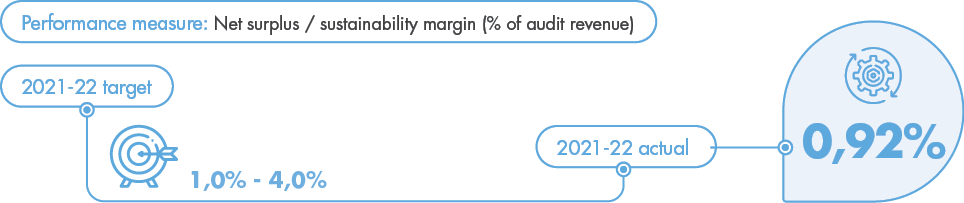

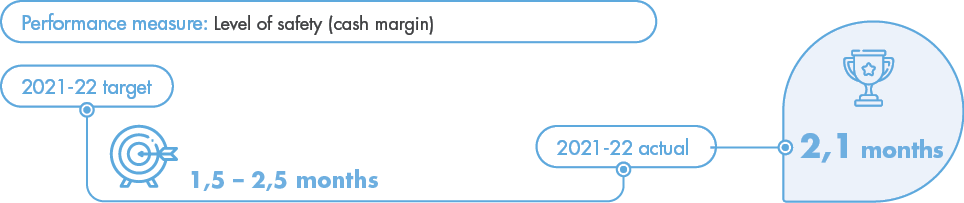

Our financial performance, the improved cash collections, cash inflows and the well-managed outflows resulted in a year-end cash balance, including short-term investments, of R770 million (2020-21: R576 million). This translates to a margin of safety of 2,1 months, which is close to the AGSA risk appetite target of three months.

Our working capital shows positive financial health, with an acid test ratio of 0,92:1 (2020-21: 0,80:1), which is just below the norm of 1:1. This means that for every one rand that we owe and have to pay to creditors within the next 12 months, we have ninety two cents to cover the payment.

Optimise own hours’ revenue with resource pooling and reducing outsourced work

We saved R129 million as at 31 March 2022 by resource pooling, where we prioritise using our own resources before considering outsourcing work.

However, a certain amount of additional outsourcing was unavoidable to assist on the national and provincial interim audits without pooling resources from the delayed local government audits. A total of R17 million was allocated to national outsourced contracts, which makes the true reflection of revenue generated through resource pooling R112 million in 2021-22.

For the national and provincial audit cycle resource pooling was R16,6 million, where our regional offices provided assistance on audits that required a provincial presence. Our specific national audit units generated R23 million by adopting provincial audits, which helped to meet our commitment on planned audits.